+ Lara Hemels

The accessibility of 3D printing can also make an incredible impact on the democratization of design. Through 3D printers being available in schools and generally being relatively low-cost, younger generations are much more likely to experiment and participate in thinking about how we interact with our objects. Design is no longer purely in the hands of the 1% but can be completely reimagined through 3D printing.

+ Pieter Hemels

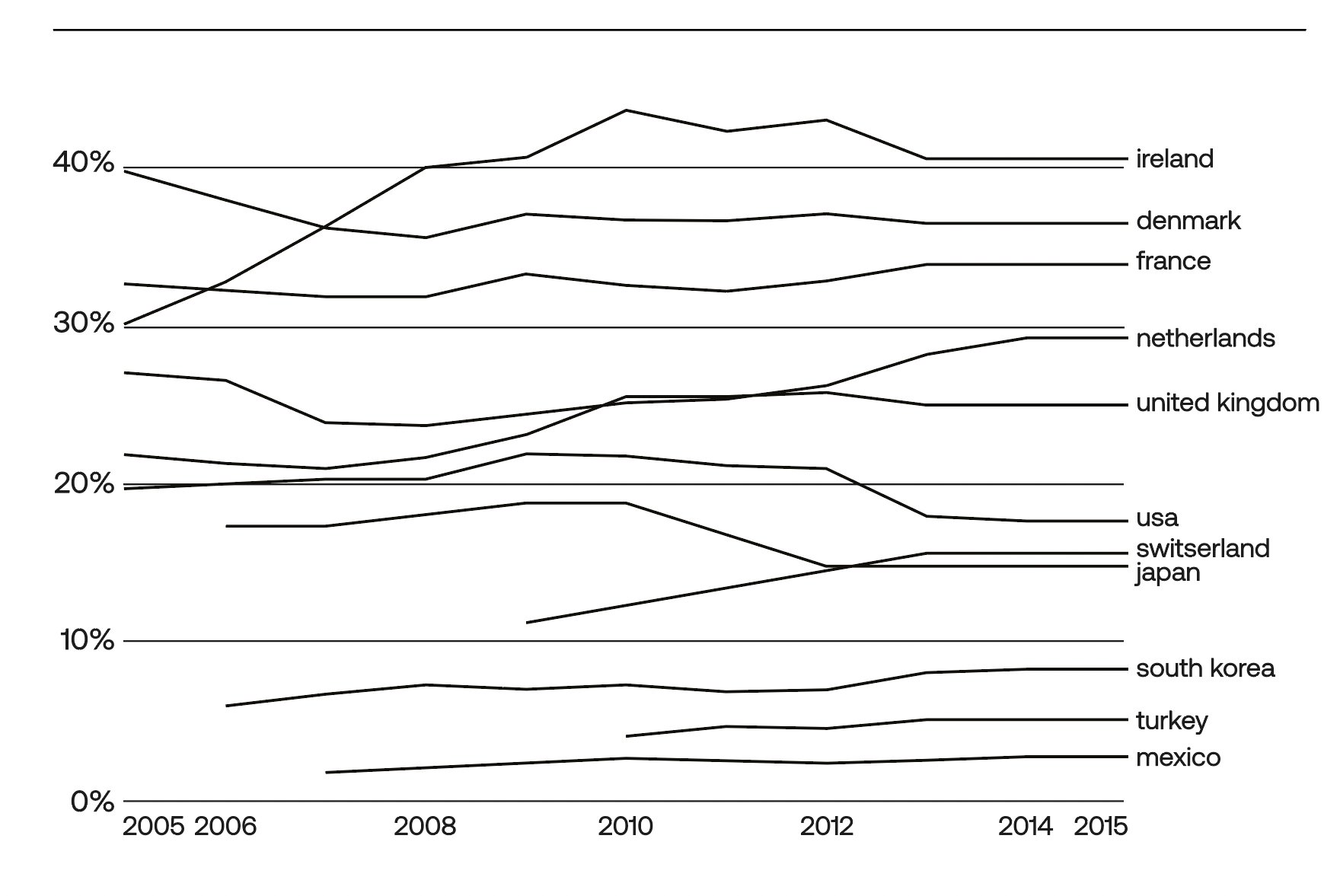

Pressure on these organizations leads to more awareness and commitment: 29 of the top 30 financial institutions have committed to net-zero by 2050. Unfortunately, it might also lead to ‘greenwashing.’ Of these 29 financials, only 11 have short-term targets. None of them has fossil fuel financing policies aligned with IEA/IPCC net-zero scenarios. We don’t need promises but factual behavior if we want to change.

Sources: link, link

+ Lara Hemels

I hope businesses will also increasingly consider integrating sustainable models for their employees. When we prioritize sustainable and equitable practices for employees -- like focussing on (mental) health and equal opportunity -- a company's environmental sustainability and health can prosper even further.

+ Kim Tan

This is becoming popular and successful in Southeast Asia as well. A lot of Filipinos do this full-time! The average GMV growth in the Philippines in terms of live-selling is 309%, the highest in Southeast Asia. Source: link

+ Elias Sohnle Moreno

Let's be aware that the increasing demand for sustainable products pushes companies to become more sustainable and "appear" more sustainable; greenwashing—is an interesting discussion together with consumer behavior. Many studies show that although consumers want sustainable products, they are not willing to go to great lengths to find out how sustainable their products are. This provides a strong incentive for companies to highlight one specific sustainable product feature that is often dwarfed by the social/environmental damage to other features of the product produced.

+ Chadia Mouhdi

This is very interesting. In today's day and age, a 'small' company with few employees can generate significant revenue and have a lot of impact and influence. Surprisingly, such companies are not mandated by law on how they address social and environmental challenges. So, I think that company size ≠ (potential) influences or impacts.

+ Emma Datema

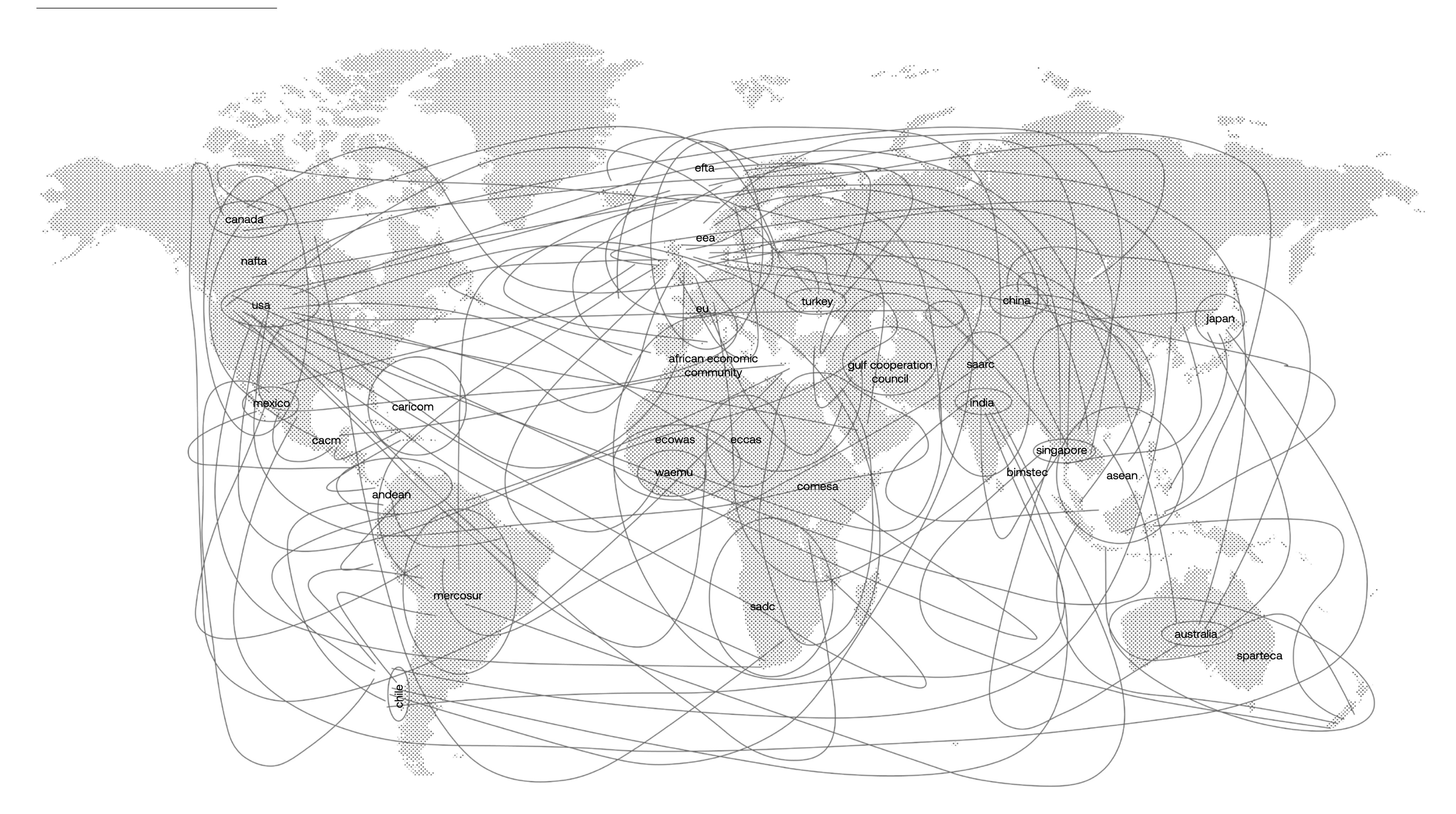

For those interested in understanding more about free markets, capitalism, and development economics, I truly recommend Ha-Joon Chang's "Bad Samaritans: The Myth of Free Trade and the Secret History of Capitalism". Critical and informative, this book sheds much-needed light on how many developed countries became rich from closing their economies off during phases of development but demand openness from countries labeled as currently developing. Furthermore, it discusses the role of IMF and World Bank regulations and how often the conditions imposed on countries have the exact opposite effect of what the loans, policies, and conditions were supposedly intended to achieve.

+ Anne Clerx

The Covid-19 pandemic has probably greatly accelerated this development. I wonder if we would have ever reached the current remote work and virtual meetings levels if the pandemic had not existed.

+ Camera Ford

This is very interesting research! It brings to mind Rob Hopkins’ book “From what is to what if: unleashing the power of imagination to create the future we want.” Hopkins’ message is that society needs to rekindle its collective imagination to build a better future. Around the world, people and communities are tapping into the power of imagination and free play as a way to connect back to the natural world and nurture collective health and mental freedom. I can imagine that this desire to be creative and identify passions and professional purpose stems from a similar urge to feel more alignment in one’s work life. The shifting landscape of the work world could give opportunities to place more emphasis back on developing intuition and imagination at all stages of life rather than forcing people to mold themselves to fit whatever a restrictive job market requires of them.

+ Pieter Hemels

Recently, ftrprf did an intensive study on 'work in 2030' in the Netherlands (when you read Dutch and want to have the survey, send a mail to info@ftrprf.com, and we'll make sure you get the 200-page book). Interpreting 20 big influencers of work in the coming decade (like 'aging,' 'flexibilization,' 'social security,' and 'opportunities equality'), we developed four scenarios on the future of work, defined by two significant uncertainties: the access to welfare & the impact of technology. The way we organize these two (individually or collectively, focusing on efficiency or participation) will have a tremendous effect on the way of working and society as a whole. Source: link

+ Line Gammelgaard Jensen

It is one thing to communicate about purpose and values; it is another thing to actually act it out and make it part of the entire company/organization. From past experiences, I've seen a disconnect between the two.

+ Line Gammelgaard Jensen

As our work moves more and more from the office to our homes, it brings new challenges to work-life balance. It can be difficult to really switch off work when working from home, and, therefore, the workday often becomes much longer. On the other hand, working from home also brings more freedom to your day and allows you to plan much better. However, it is something to be mindful of.

+ Pieter Hemels

What often remains underexposed in the discussion about a rapidly aging society is that in the coming decade, there will be three movements co-occurring in Europe:

1. The number of retirees is rising fast

2. The number of workers between the ages of 45 and 65 is decreasing and

3. The number of workers between the ages of 25 and 65 is increasing rapidly.

The latter point is at least as relevant as the first point. In 2030, most of the working population will consist of generations Y & Z, generations far more concerned than their parents and grandparents with sustainability and the future of the planet. They also actively look for purpose in their work and are very aware of the scarcity of labor and, therefore, their value. This offers a particularly positive outlook for purpose-driven organizations that involve young generations in their entire business operations. Sources: link, link

+ Chia-Erh Kuo

I love this short conclusion! Perhaps it's also interesting to look into how the Japanese government has been trying to keep the elderly in the labor market longer to sustain the country's economic competitiveness. A more elderly labor market is believed to benefit countries facing an acute labor shortage. Source: link

+ Chia-Erh Kuo

To foster inclusivity, companies must make meaningful changes. For many, narrowing the gender gap should be the priority.

In my observation, a recent international regulatory trend might help us build a more equal workplace. Some governments have started pushing corporations to make their first step: UK companies are already required to publish an annual report containing data on their gender pay gap. In the future, companies employing at least 250 people in the EU will also have to start providing data on wage data. Sources: link, link

+ Elias Sohnle Moreno

This chapter talks extensively (and very well) about job displacement but doesn't consider the potential scenario of net job destruction due to automation. It seems to take for granted that automation will create as many employment opportunities as it replaces. What if automation destroys more jobs than it creates? How could this scenario impact demographics and livelihoods, especially given that the available workforce will grow significantly?

+ Chia-Erh Kuo

Agree! I think automation will likely become a nightmare for vulnerable employment, especially in some labor-intensive industries or developing countries.

+ Elias Sohnle Morero

I consider that central banks are entering the digital currency arena as a response to the threat to the central banks' control over money circulation caused by the adoption of cryptocurrencies.

+ Elias Sohnle Morero

AI is improving the skills that we thought were unique to us, like creativity, empathy, etc. Could the emergence of Artificial General Intelligence (AGI) truly make humans obsolete? Even if it is highly speculative, can our welfare systems guarantee decent livelihoods for the majority of people if they become idle over the course of the next century?

+ Elias Sohnle Moreno

By reading this, two questions come to my mind: Could this affect employment significantly? How could this impact economies that are heavily relying on the first and secondary sectors?